Tech stocks plunged Monday as the launch of DeepSeek, a cost-efficient Chinese artificial intelligence model, triggered fears of disrupted market dominance for AI leaders like Nvidia. The chipmaker suffered a staggering $593 billion market-cap loss—the largest single-day loss in Wall Street history.

The selloff began after DeepSeek’s free AI assistant, launched last week, surpassed OpenAI’s ChatGPT in downloads on Apple’s App Store. Investors reacted swiftly, wiping out significant market value across the tech sector. Nvidia shares dropped nearly 17%, closing at $118.42, marking a historic one-day loss, according to LSEG data.

The Nasdaq Composite Index fell 3.1%, led by Nvidia and other tech giants. Broadcom dropped 17.4%, Microsoft declined 2.1%, and Alphabet lost 4.2%. The Philadelphia Semiconductor Index slumped 9.2%, its steepest drop since March 2020, with Marvell Technology plunging 19.1%.

The selloff rippled across global markets. In Asia, Japan’s SoftBank Group fell 8.3%, while in Europe, ASML tumbled 7%. Safe-haven assets like U.S. Treasuries rallied, with the benchmark 10-year yield falling to 4.53%.

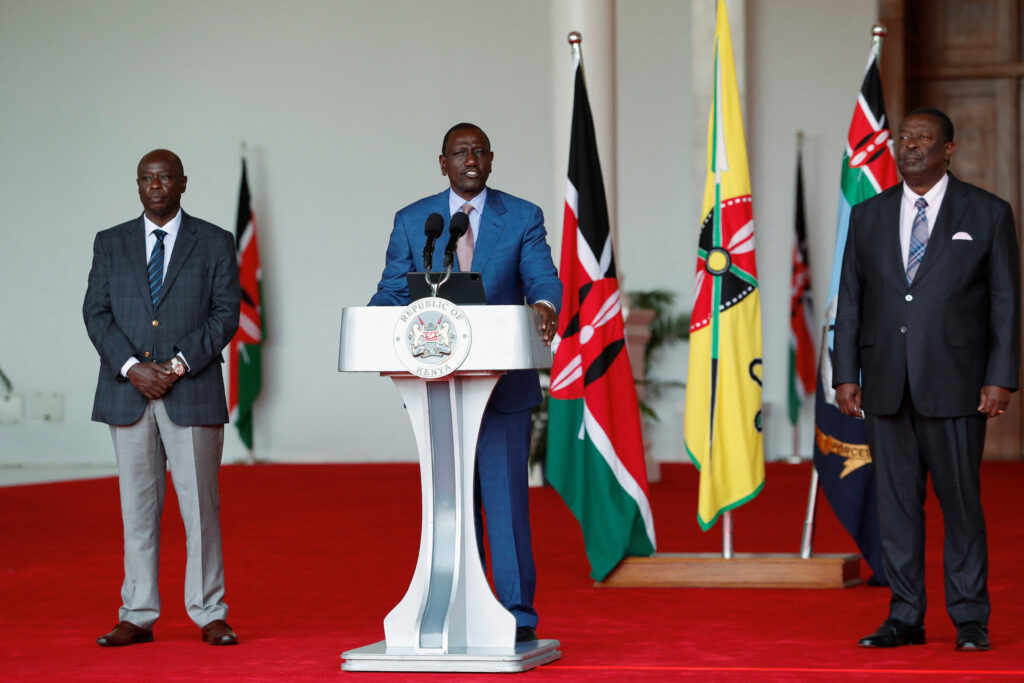

Kenyan President William Ruto called for an emergency summit within 48 hours to address economic uncertainties stemming from the tech sector volatility.

DeepSeek, developed by a Hangzhou-based startup, has been praised for its cost efficiency and performance. Its R1 model is 20 to 50 times cheaper than OpenAI’s models and uses Nvidia’s lower-capability H800 chips, costing less than $6 million for training.

The emergence of DeepSeek represents a significant challenge to incumbent AI firms. Silicon Valley venture capitalist Marc Andreessen called it AI’s “Sputnik moment,” likening it to the Soviet Union’s space race breakthrough.

While the selloff underscored fears of disruption, some analysts argued it was overblown. “DeepSeek targets mobile and PC AI applications, not data centers, which remain Nvidia’s core business,” said Daniel Morgan, senior portfolio manager at Synovus Trust Company.

Despite Monday’s plunge, Nvidia shares remain up 171% in 2024 and 239% in 2023. Investors like Morgan view the selloff as an opportunity to buy high-quality tech stocks at lower valuations.

The hype around AI, which has driven massive capital inflows over the past 18 months, faced its first major setback. AI-related power utility stocks, like Vistra (-28.3%), Constellation Energy (-20.8%), and NRG Energy (-13.2%), also plummeted as investors recalibrated expectations for data center demand.

Meanwhile, Vertiv Holdings, which builds data center infrastructure, fell 29.9%, reflecting concerns over reduced growth prospects for AI-related infrastructure.

DeepSeek’s entry signals a turning point in the AI race, with Chinese tech innovation challenging U.S. market dominance. The disruption underscores the rapid pace of technological advancement and its implications for global markets.