Walmart has issued an apology after a customer in Kansas claimed she had been overcharged during a recent visit to the grocery store. Diane Bulleigh noticed that her receipt wasn’t quite right and knew something was amiss.

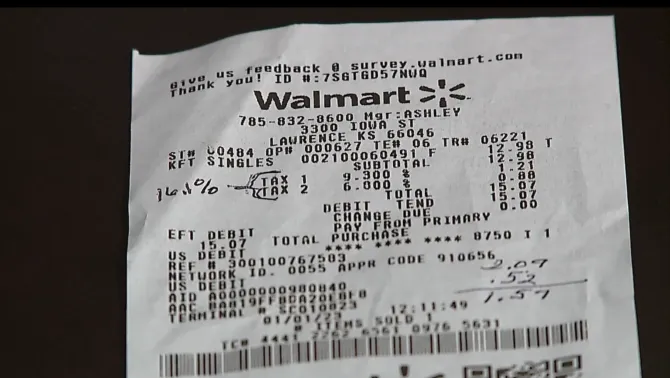

According to WDAF-TV, a Fox affiliate, Bulleigh had purchased items totaling $12.98 in 2023, but her final bill came to $15.07. Upon closer inspection, she realized that she had been charged two different tax rates: one line on her receipt showed a 9.3% charge, while another stated 6.8%.

“I’m going, ‘That’s not right,'” Bulleigh expressed her frustration. Although she was reimbursed for the 9.3% charge, she did not receive a refund for the second figure.

It was later discovered that the correct grocery tax rate was 4%, along with smaller city and county charges. Walmart acknowledged the error that appeared on Bulleigh’s receipt and issued an apology.

“On Jan. 1, after the reduced state sales tax rate on food items went into effect in Kansas, some customers were mistakenly charged the higher, outdated rate, along with the new rate,” a Walmart spokesperson explained. “The issue has been resolved, and we apologize for any inconvenience.”

The incident occurred on the day that Kansas’s food sales tax rate was reduced from 6.5% to 4%. Since then, the sales tax has been further decreased to 2% as of January 2024 and is set to reach 0% in January 2025.

Kansas Governor Laura Kelly praised the gradual decrease, stating, “By taking a middle-of-the-road approach, we have been able to continue putting money back in the pockets of every Kansan.” She estimated that the reduction from 4% to 2% would help shoppers across the state save $12.5 million per month, with a family of four potentially saving around $17 a month, or more than $200 over a year.

However, it’s important to note that certain products, such as alcohol and tobacco, are exempt from the food sales tax cut and remain subject to the 6.5% rate.

Sales tax rates vary across the United States, with Tennessee’s grocery tax at 4% and Mississippi’s essential items taxed at 7%. In contrast, Arkansas has a significantly lower grocery tax rate of 0.125%. A bill proposed in March 2023 to eliminate the tax in Arkansas did not pass.

The U.S. Sun has reached out to Walmart for further comment on the overcharge incident and the company’s response.

Bulleigh’s experience serves as a reminder for shoppers to carefully review their receipts and be aware of the applicable tax rates in their area to ensure they are not being overcharged for their purchases.