In a recent interview with Channels Television, a Nigerian television channel, Bismarck Rewane, the Managing Director and Chief Executive Officer of Financial Derivatives Company Limited, made a startling revelation that Ghana has now surpassed Nigeria in terms of wealth and economic growth. This statement comes as a significant shift in the economic landscape of the two West African nations.

Rewane, a renowned economist, pointed out that Nigeria has experienced a decline in its global economic ranking, falling from the 32nd largest economy in the world to the 42nd position. Furthermore, he highlighted that Nigeria has also slipped from its first position in Africa to the fourth place in terms of wealth management and accumulation.

Emphasizing the reversal of fortunes, Rewane stated, “In the past, we were always richer than Ghana, now we are here. External reserves and GDP figures speak for themselves.” This statement underscores the stark contrast between the two countries’ economic trajectories.

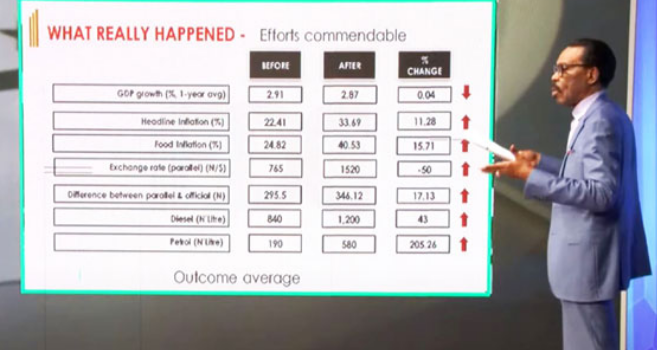

In March of this year, Rewane was appointed as a member of President Bola Tinubu’s Economic Management Team Emergency Taskforce (EET), tasked with formulating and implementing a consolidated emergency economic plan. Speaking on the first anniversary of Tinubu’s term in office, Rewane categorized Nigeria’s economic performance into the good, bad, and ugly based on available metrics.

Rewane provided a comparative analysis of economic indicators among African countries, revealing that Nigeria’s GDP growth stood at 2.98% last year, while South Africa, Kenya, and Ghana recorded growth rates of 1.93%, 4%, and 3.8%, respectively. Inflation rates also painted a challenging picture, with Nigeria at 33%, South Africa and Kenya at 5%, and Ghana at 25%.

The GDP per capita figures further highlighted the disparity, with Nigeria at $1,111, South Africa at $6,700, Kenya at $2,000, and Ghana at $2,200. Rewane noted that external reserves as a percentage of GDP illustrate a tough picture for Nigeria.

Despite the challenging economic landscape, Rewane expressed optimism for improvement in the Nigerian economy. He pointed out that major policy changes were announced in 2023, including the $1 trillion GDP goal, but the time lag between policy announcements and their effects was a drag on outcomes, leading to unintended consequences and social unrest.

Rewane highlighted the cost of living crisis in Nigeria and the ongoing minimum wage negotiations as sources of widespread conflict. He attributed the wrong sequencing of reforms to the toll on output and identified both structural and exogenous factors contributing to the economic weakness.

Looking ahead, Rewane stated that Nigeria needs new borrowing to refinance existing obligations and that policy changes, institutional reforms, and new borrowings are expected to lead to positive and faster growth from 2025 to 2026.

The economist also reviewed President Bola Tinubu’s promises, policies, and announcements a year after assuming office, including increasing GDP to $1 trillion in eight years, removing petroleum subsidies, unifying exchange rates, overhauling security infrastructure, doubling power generation, and bringing inflation under control.

As Ghana surpasses Nigeria in wealth accumulation and economic growth, it serves as a wake-up call for Nigerian policymakers to address the structural and exogenous challenges hindering the nation’s economic progress. The path forward requires strategic reforms, institutional changes, and targeted investments to unlock Nigeria’s vast potential and regain its position as a leading economic powerhouse in Africa.